Chief executive officer at Sold, Nest Joseph drives the critical vision and also functions very closely on all elements of our service as we continue to expand as well as develop the Sold, Nest system. Prior To Sold, Nest, he was a realty representative and also broker, following a period of concerning 7 years when he had a home mortgage firm - Sell my house fast san antonio.

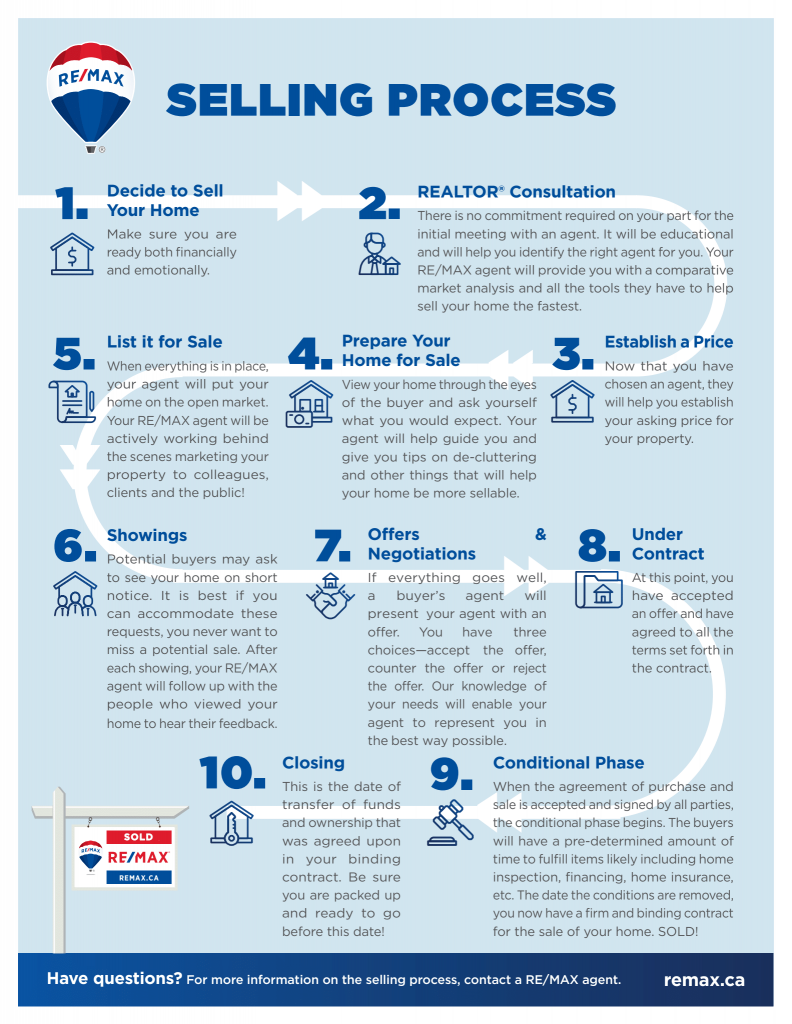

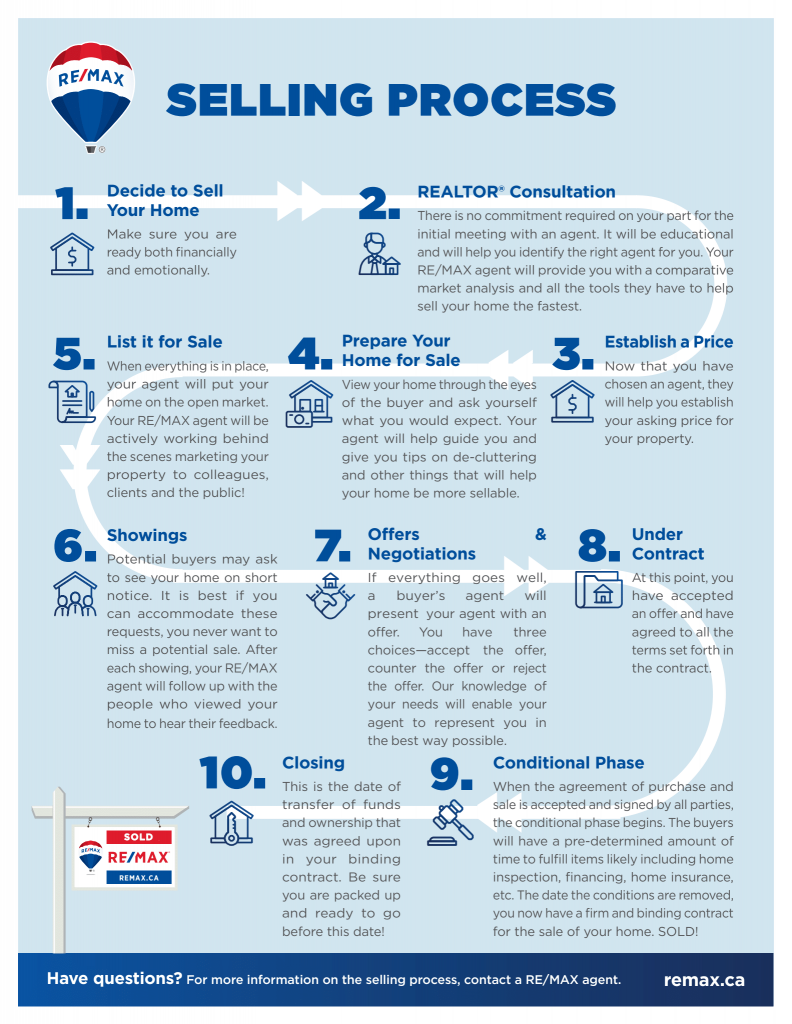

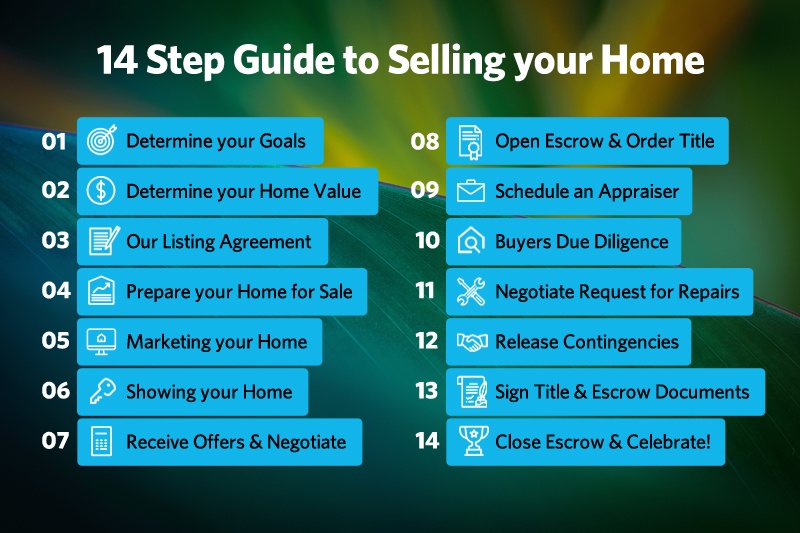

Most house sellers imagine a worry-free sale in which they merely note their house, swiftly find a qualified buyer, gather the cash and turn over the tricks. So it were that easy! Actually, selling a house entails many moving parts some that you can manage, and some that are out of your hands.

You'll desire to be prepared as a seller as well as control the aspects that can have a big influence on your lower line. Things like working with a great property agent and also maximizing your home's online charm can equate right into a more seamless closing and also more deposit.

The quantity sellers stand to save on those charges can be thousands of bucks, normally 5 percent or 6 percent of the overall sale rate. An experienced representative does a whole lot to make their fee - House buyer near San Antonio Texas.

When functioning with an agent as well as discussing a payment, keep this in mind: Property charges have dropped to all-time lows. So you may be able to get a break at the closing table. Offering a residence is a major endeavor that can take 2 to four months throughout or much longer, depending upon local market conditions as well as the degree of stock offered.

By being a couple of actions ahead of the customer, vendors may be able to quicken the marketing process by doing fixings in tandem with other house preparation work. This implies by the time your house strikes the market, it should prepare to sell, drama-free and quickly. If you're going to invest money on expensive upgrades, see to it that the changes you make have a high return on investment.

In fact, the reverse is typically real. Houses that are valued also high will shut off possible purchasers, who might not also think about looking at the residential property."Additionally, residences with numerous rate reductions might provide purchasers the impression there's something incorrect with your home's condition, or that it's unwanted.

After your home formally hits the market as well as customers have seen it, ideally the deals will certainly start rolling in. This is where a realty representative (or attorney) is your ideal supporter and also best source for suggestions. If your regional market is affordable and also favors sellers, purchasers will likely offer at or above asking price.

On the other hand, if sales are slow-moving in your area and also you don't obtain several deals, you may have to be open to working out. When you obtain a deal, you have a few options: Accept the offer as it is, make a counteroffer or deny the deal (Sell house fast san antonio tx). A counteroffer is a feedback to a deal, in which you discuss on terms and also rate -

.

Any shortfall between the acquisition price and also evaluated value will need to be made up somewhere, or the bargain might break down. Both the homebuyer and also seller have closing expenses. The house vendor normally pays the property representative's compensation, generally around 5 percent to 6 percent of the residence's list price.

Your realty agent or the closing agent should supply you with a full list of prices you'll be in charge of at the closing table. While the buyer usually pays a bulk of shutting expenses, anywhere from 2 percent to 4 percent of the sales cost, realize that you may need to pay some costs, as well (

Cash house buyers in san antonio

).

If you've owned and lived in your home for at the very least two out of the previous 5 years before marketing it, then you will not need to pay taxes on any revenue up to $250,000. For married pairs, the quantity you can leave out from tax obligations enhances to $500,000. If your profit from the home sale is greater than that, you require to report it to the Internal revenue service on your tax return as a capital gain.